KuCoin is a centralized exchange that has been a popular choice with many since its launch in 2017. However, there are numerous KuCoin alternatives that offer unique features, deeper liquidity, or stronger regulatory oversight, depending on your specific needs.

In this review, we look at five alternatives to KuCoin that you can consider to trade and invest in crypto.

Xverse

Xverse is a non-custodial platform accessible through a wallet and also a web app, designed to be a gateway to the broader Bitcoin ecosystem. It supports assets on both L1, such as Ordinals and Runes, and those on leading L2s, such as Stacks, Starknet, and Spark.

Key Features

- Non-custodial: You hold your private keys, meaning it is a platform that helps you to be financially sovereign.

- Gateway to Bitcoin DeFi: It offers the tools you need to interface with Ordinals, Runes, as well as Bitcoin Layer 2s like Stacks, Starknet, and Spark.

- Hardware wallet compatible: You can easily integrate with the most popular hardware wallets, notably Ledger and Keystone.

Supported Assets and Trading Types

Xverse supports Bitcoin (BTC) and most of the other assets that are created on the Bitcoin L1 and L2. It is a self-custodial wallet with in-wallet swaps, Lightning Network support, and direct access to Bitcoin-native DeFi apps for lending, borrowing, and yield generation.

Why It Stands Out

Xverse stands out because it is built to support the core Bitcoin blockchain ethos of self-custody and financial sovereignty. It allows you to participate in the Bitcoin DeFi ecosystem while maintaining full control over your assets, and that makes it entirely different, especially from custodial exchanges.

Kraken

Kraken is a US-based, regulated centralized crypto exchange known for its emphasis on compliance and security. Because it operates under strict regulatory oversight, the platform requires users to complete a thorough and sometimes lengthy Know Your Customer (KYC) verification process.

Key Features

- Regulatory compliant: As a regulated American business, Kraken adheres to strict KYC requirements.

- Custodial wallet: As a Kraken user, you have to trust the exchange to safeguard your funds.

- Long list of assets: The exchange supports a large number of crypto assets and a long list of trading pairs.

Supported Assets and Trading Types

Kraken supports more than 200 crypto assets and trading pairs, including all major coins and many altcoins. The exchange offers spot, margin, and futures trading, as well as OTC services for high-volume clients. These services you can access through its web app as well as a mobile application.

Why It Stands Out

Kraken is an exchange known for high regulatory compliance and primarily caters to the needs of traders who seek convenience. It is known to support a long list of assets and trading pairs, including major coins, altcoins, and stablecoins.

Bitstamp

Bitstamp is another highly regulated centralized crypto exchange recognized for its long operational history and high compliance. The exchange holds multiple licenses that enable it to offer services in many regions around the globe.

Key Features

- Highly regulated: Bitstamp is one of the most regulated exchanges in the world, with licenses both in the EU and the US.

- Dual interface: It has a simple dashboard for newcomers and a pro interface for advanced charting.

- Institutional-grade security: As one of the world’s longest-running crypto exchanges, Bitstamp is known to provide a highly secure trading environment.

Supported Assets and Trading Types

Bitstamp focuses on established, high-liquidity assets such as bitcoin, ethereum, and major stablecoins. It mainly offers spot trading with simple order types such as instant, limit, and stop orders. It also offers over-the-counter (OTC) products, especially for institutional clients.

Why It Stands Out

Bitstamp stands out as one of the oldest still active exchanges, having been founded in 2011. It is also one of the highly regulated crypto marketplaces. While it has had its share of challenges, the exchange has continued to be an option for many around the world.

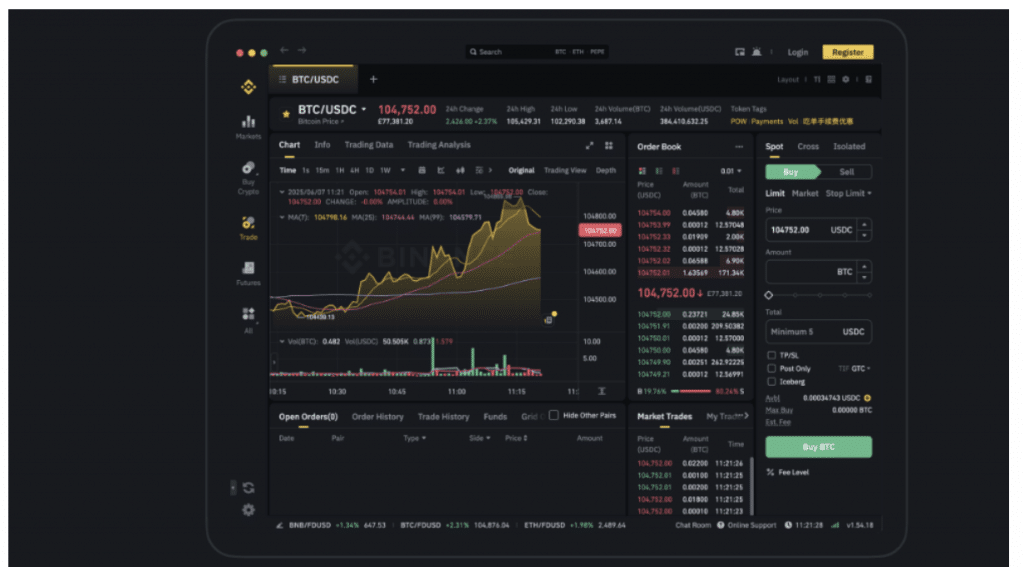

Binance

Binance is one of the largest centralized cryptocurrency exchanges. It offers a wide range of digital asset products and solutions, including spot, futures, margin, and peer-to-peer (P2P) trading. It also supports one of the longest lists of crypto assets.

Key Features

- Binance Launchpad: Projects and teams can create and launch new tokens using the platform.

- Binance Academy: The exchange runs and maintains an online platform that provides an extensive free educational resource library

- BNB Chain: The exchange is the original creator and supporter of the blockchain network that hosts crypto projects.

Supported Assets and Trading Types

Binance supports hundreds of cryptocurrencies and trading pairs, ranging from major to new project listings. It offers spot, margin, futures, and options trading, as well as leveraged tokens and an NFT marketplace.

Why It Stands Out

Binance is ideal for traders who prioritize liquidity, speed, and variety over self-custody. It offers an extensive ecosystem for active trading and asset diversification. The exchange stands out as one of the centralized exchanges that offer its users the P2P trading option.

Coinbase

Coinbase is another highly regulated centralized exchange. It is also one of the most well-known entry points for new crypto investors. Besides buying and selling assets, the exchange offers a wallet, a learning program, and yield products. It also offers services to institutions that participate in the crypto market.

Key Features

- Highly compliant: The exchange is one of the most regulated in the industry through multiple licenses.

- Publicly traded company: The company was the first crypto exchange whose shares are traded under strict financial oversight.

- User-friendly experience: Coinbase is known for its intuitive interface and educational resources.

Supported Assets and Trading Types

Coinbase supports a wide range of crypto assets, with a strong focus on regulatory compliance. The exchange offers buy/sell service to retail traders, as well as spot and futures trading. It also offers infrastructural, custodial, and financing services to institutional clients.

Why It Stands Out

Coinbase is the go-to exchange for retail users who prefer using highly regulated exchanges with strict KYC requirements for crypto trading. The exchange does stand out for its learning program, which incentivizes users through rewards.

Which Alternative Stands Out?

Your choice of platform depends on what you value most, as well as your strategy and goals. If self-custody, Bitcoin-native assets, and financial sovereignty are the things that you value the most, then Xverse is clearly the option to seriously consider.

On the other hand, if you don’t midn handing over your custody to a third-party and want high levels of regulatory compliance, you should be looking at exchanges like Kraken, Bitstamp, or Coinbase.

Last Updated on November 7, 2025